```html

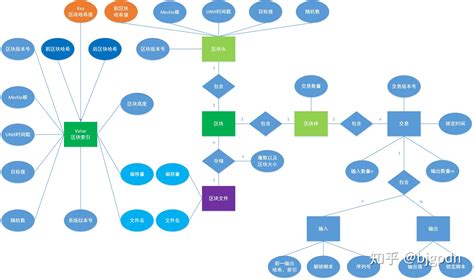

Blockchain Mobile Payment Process

Blockchainbased mobile payment systems offer a secure and transparent way to conduct transactions. Below is a simplified flowchart depicting the typical process:

- Security: Transactions are cryptographically secured, reducing the risk of fraud and unauthorized access.

- Transparency: All transactions are recorded on a distributed ledger, providing visibility to all network participants.

- Decentralization: The absence of a central authority eliminates single points of failure and enhances resilience.

- Efficiency: Blockchain enables faster and cheaper crossborder transactions compared to traditional methods.

- Privacy: Users can maintain anonymity while conducting transactions, as personal information is not directly tied to wallet addresses.

While blockchain mobile payments offer numerous advantages, there are also some considerations to keep in mind:

- Scalability: Current blockchain networks may face scalability issues, leading to slower transaction processing times during periods of high demand.

- Regulatory Compliance: Regulatory frameworks surrounding cryptocurrencies and blockchain technology vary across jurisdictions, requiring businesses to navigate legal complexities.

- User Experience: Improving the user experience of blockchainbased mobile payment applications is crucial for widespread adoption, as some users may find the technology intimidating or confusing.

- Volatility: Cryptocurrency prices can be highly volatile, posing risks to both merchants and consumers in terms of transaction value fluctuation.

Despite these challenges, the adoption of blockchain technology in mobile payments is expected to continue growing as businesses and consumers recognize the benefits of decentralized and secure transactions.